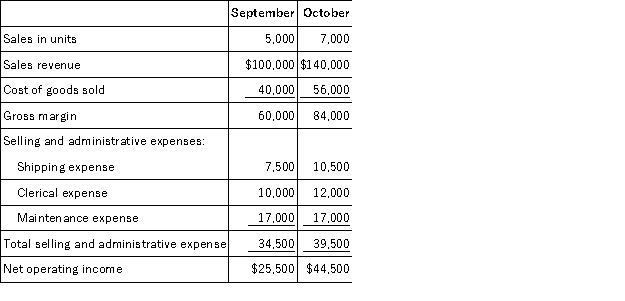

Comparative income statements for Tudor Retailing Company for the last two months are presented below:  Which of the following classifications best describes the behavior of clerical expense?

Which of the following classifications best describes the behavior of clerical expense?

Definitions:

Personal Property Taxes

Taxes levied by local governments on the value of personal property such as vehicles, boats, and equipment.

FICA Taxes

Federal taxes required to be deducted from employees' wages for Social Security and Medicare, also paid in part by employers.

Adjusted Gross Income

The measure of one's taxable income, calculated as gross income minus allowable adjustments.

Deductible Contribution

A contribution to a qualified plan or account that is eligible to be deducted from the contributor's gross income for tax purposes.

Q2: You have deposited $15,584 in a special

Q8: A furniture manufacturer uses a standard costing

Q21: In computing its predetermined overhead rate,Brady Company

Q24: Lafoe Corporation produces two intermediate products,A and

Q28: Two or more products produced from a

Q29: If <span class="ql-formula" data-value="f (

Q29: Brenneis,Inc. ,manufactures and sells two products: Product

Q56: In a standard costing system where the

Q87: If a company has a great deal

Q154: Dunnivan,Inc. ,manufactures and sells two products: Product