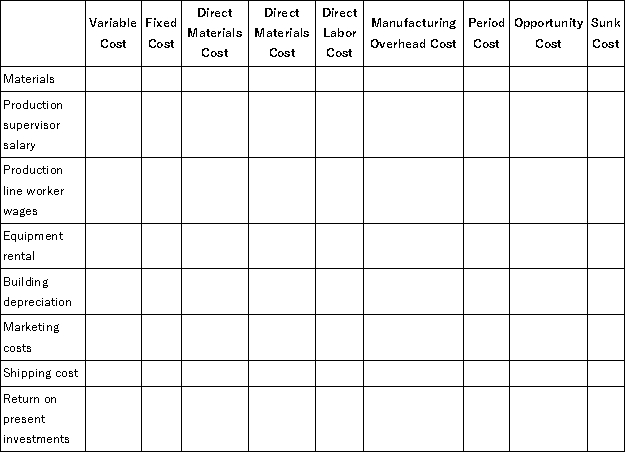

The Plastechnics Company began operations several years ago.The company's product requires materials that cost $25 per unit.The company employs a production supervisor whose salary is $2,000 per month.Production line workers are paid $15 per hour to manufacture and assemble the product.The company rents the equipment needed to produce the product at a rental cost of $1,500 per month.The building is depreciated on the straight-line basis at $9,000 per year.

The company spends $40,000 per year to market the product.Shipping costs for each unit are $20 per unit.

The company plans to liquidate several investments in order to expand production.These investments currently earn a return of $8,000 per year.

Required:

Complete the answer sheet below by placing an "X" under each heading that identifies the cost involved.The "Xs" can be placed under more than one heading for a single cost,e.g. ,a cost might be a sunk cost,an overhead cost,and a product cost.

Definitions:

Chart of Accounts

An organizational tool that lists all the accounts in a company's general ledger, categorizing financial transactions into specific classes for reporting and analysis purposes.

Framework

A basic conceptual structure underlying a system, concept, or text, often guiding further development or thought.

Accounting Database

A digital collection of financial information and records that supports the storage, retrieval, management, and analysis of accounting data.

Prepaid Expenses

Expenses paid in advance for goods or services to be received in the future, recognized as assets on the balance sheet.

Q3: Traveller Corporation sells one product and uses

Q9: Homer Corporation has a standard cost system

Q16: A series circuit consists of a

Q26: Find the length of the curve.

Q27: Acuff Corporation applies manufacturing overhead to products

Q31: Acton Corporation,which applies manufacturing overhead on the

Q50: Hadrana Corporation reports that at an activity

Q60: Trezise,Inc. ,manufactures and sells two products: Product

Q125: Frogge,Inc. ,manufactures and sells two products: Product

Q129: Buker Corporation bases its predetermined overhead rate