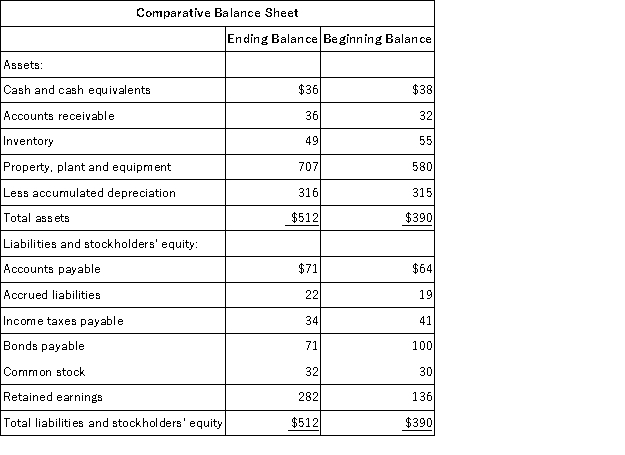

Kilduff Corporation's balance sheet and income statement appear below:

The company sold equipment for $19 that was originally purchased for $10 and that had accumulated depreciation of $5.The company paid a cash dividend of $44 and it did not issue any bonds payable or repurchase any of its own common stock. The net cash provided by (used in) financing activities for the year was:

The company sold equipment for $19 that was originally purchased for $10 and that had accumulated depreciation of $5.The company paid a cash dividend of $44 and it did not issue any bonds payable or repurchase any of its own common stock. The net cash provided by (used in) financing activities for the year was:

Definitions:

Heart

A muscular organ that pumps blood throughout the body, supplying oxygen and nutrients while removing waste products.

Involuntary Muscle Tissue

Muscle tissue that operates without conscious control, responsible for movements in the heart, digestive system, and other organs.

BRCA Analysis

A genetic test that checks for mutations in the BRCA1 and BRCA2 genes, known to increase the risk of breast and ovarian cancer.

Polymerase Reaction

A laboratory technique used to amplify DNA sequences, known as polymerase chain reaction (PCR).

Q4: On March 1,Metevier Corporation had $37,000 of

Q39: Sawyer Manufacturing Corporation uses a predetermined overhead

Q43: When the actual wage rate paid to

Q59: Oldham Corporation bases its predetermined overhead rate

Q92: Filosa,Inc. ,manufactures and sells two products: Product

Q93: The salary paid to the maintenance supervisor

Q98: On the Schedule of Cost of Goods

Q108: Kamerling,Inc. ,manufactures and sells two products: Product

Q119: Betenbaugh,Inc. ,manufactures and sells two products: Product

Q159: All of the following would be classified