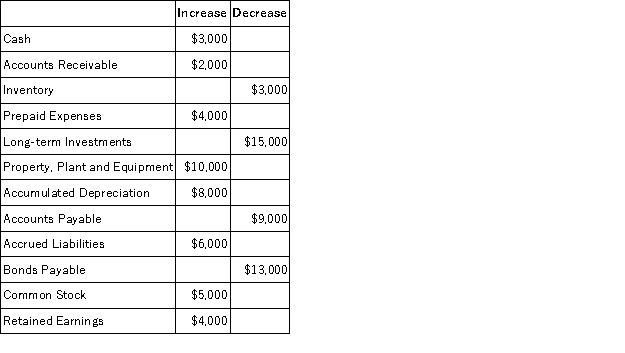

The change in each of Kendall Corporation's balance sheet accounts last year follows:  Kendall Corporation's income statement for the year was:

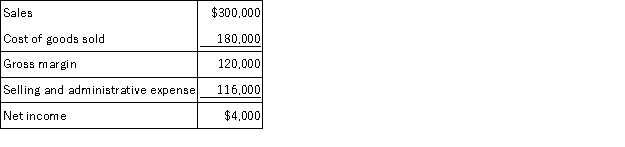

Kendall Corporation's income statement for the year was:  There were no sales or retirements of property,plant,and equipment and no dividends paid during the year.The company pays no income taxes and it did not purchase any long-term investments,issue any bonds payable,or repurchase any of its own common stock.The net cash provided by operating activities on the statement of cash flows is determined using the direct method. The selling and administrative expense adjusted to a cash basis would be:

There were no sales or retirements of property,plant,and equipment and no dividends paid during the year.The company pays no income taxes and it did not purchase any long-term investments,issue any bonds payable,or repurchase any of its own common stock.The net cash provided by operating activities on the statement of cash flows is determined using the direct method. The selling and administrative expense adjusted to a cash basis would be:

Definitions:

Ending Inventory

The total value of all goods available for sale at the end of an accounting period, not yet sold.

Variable Production Costs

Costs that vary directly with the level of production, such as materials, labor, and utilities needed for manufacturing.

Absorption Costing

An accounting method that includes all manufacturing costs (direct materials, direct labor, and both variable and fixed manufacturing overhead) in the cost of a product.

Unit Product Cost

The total cost (both fixed and variable) associated with producing a single unit of a product.

Q13: Acton Corporation,which applies manufacturing overhead on the

Q21: Cridberg Corporation's selling and administrative expenses for

Q21: Compound K52E is a raw material used

Q35: At a sales volume of 30,000 units,Carne

Q50: The Murray Corporation makes and sells a

Q68: Farnsworth Television makes and sells portable television

Q70: Semaan Corporation applies manufacturing overhead to products

Q100: Bradbeer Corporation uses direct labor-hours in its

Q136: Krimton Corporation's manufacturing costs last year consisted

Q150: Besser,Inc. ,manufactures and sells two products: Product