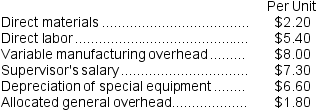

Ramon Corporation makes 18,000 units of part E44 each year.This part is used in one of the company's products.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make and sell the part to the company for $23.30 each.If this offer is accepted,the supervisor's salary and all of the variable costs,including direct labor,can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted,only $5,000 of these allocated general overhead costs would be avoided.In addition,the space used to produce part E44 would be used to make more of one of the company's other products,generating an additional segment margin of $21,000 per year for that product.

An outside supplier has offered to make and sell the part to the company for $23.30 each.If this offer is accepted,the supervisor's salary and all of the variable costs,including direct labor,can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted,only $5,000 of these allocated general overhead costs would be avoided.In addition,the space used to produce part E44 would be used to make more of one of the company's other products,generating an additional segment margin of $21,000 per year for that product.

What would be the impact on the company's overall net operating income of buying part E44 from the outside supplier?

Definitions:

Long Run

The long run is a period in which all inputs and production technologies can be varied, with no fixed factors of production.

Long-Run

Pertains to a period in which all factors of production and costs are variable, allowing companies to adjust all inputs.

AVC

Average Variable Cost, the total variable cost divided by the number of units produced, reflecting costs that change with output.

Short-Run

A period during which at least one of a firm's inputs is fixed, limiting its ability to adjust to demand changes.

Q6: In a special order situation,any fixed cost

Q8: Use differentials to estimate the amount

Q15: Use the Chain Rule to find

Q30: Committed fixed costs represent organizational investments with

Q31: Find the area of the region

Q56: Zuppa Corporation currently maintains its own printing

Q62: Solve the differential equation. <span

Q74: Find the gradient of the function

Q74: Which of the following is not an

Q85: Emerton Corporation leases its corporate headquarters building.This