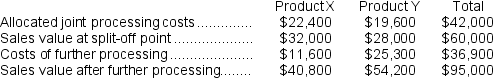

Iaci Company makes two products from a common input.Joint processing costs up to the split-off point total $42,000 a year.The company allocates these costs to the joint products on the basis of their total sales values at the split-off point.Each product may be sold at the split-off point or processed further.Data concerning these products appear below:

Required:

Required:

a.What is the net monetary advantage (disadvantage)of processing Product X beyond the split-off point?

b.What is the net monetary advantage (disadvantage)of processing Product Y beyond the split-off point?

c.What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d.What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Definitions:

Equivalent Units

A concept in cost accounting used to allocate costs to partially completed goods in process costing environments, treating them as if they were whole units.

Process Costing

An accounting method used to allocate costs to units of product in continuous, homogeneous production processes.

Department A

A specific segment or division within an organization that focuses on a particular set of tasks or responsibilities.

Equivalent Units

A concept in cost accounting used to equate units of production in various stages of completion to a number of fully completed units.

Q5: Find <span class="ql-formula" data-value="h(x, y)=g(f(x,

Q25: Evaluate the line integral. <span

Q29: Compound K52E is a raw material used

Q37: Let <span class="ql-formula" data-value="\mathbf {

Q38: Calculate the double integral. <span

Q40: Find <span class="ql-formula" data-value="h (

Q50: The standards for product F28 call for

Q58: Express the triple integral <span

Q79: Northern Stores is a retailer in the

Q173: At a sales volume of 37,000 units,Maks