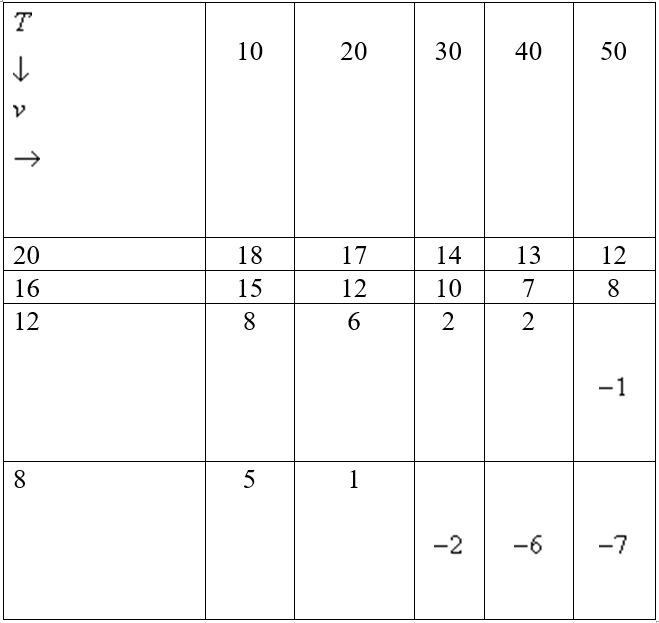

The wind-chill index I is the perceived temperature when the actual temperature is T and the wind speed is v so we can write . The following table of values is an excerpt from a table compiled by the National Atmospheric and Oceanic Administration. Use the table to find a linear approximation to the wind chill index function when T is near and v is near 30 kmh.

Definitions:

Deferred Taxes

Taxes that are incurred in one period but are not paid until a future period, often due to timing differences between accounting and tax reporting.

Taxable Entity

A business or individual that is required to pay taxes to a federal, state, or local government.

Permanent Difference

These are differences between taxable income and accounting income that originate in one period and do not reverse over time, affecting taxable income and tax liability.

Temporary Difference

A discrepancy between the tax base of an asset or liability and its carrying amount on the balance sheet that results in taxable or deductible amounts in future years.

Q4: Evaluate the line integral <span

Q9: Determine whether the sequence defined by

Q49: Find an approximation of the sum

Q62: Find an equation for the conic

Q74: Sketch the curve of the vector

Q81: The ellipsoid <span class="ql-formula" data-value="8

Q82: Find the equation of the normal

Q88: Find <span class="ql-formula" data-value="\mathbf {

Q134: Suppose that the radius of convergence

Q148: Find the radius of convergence and