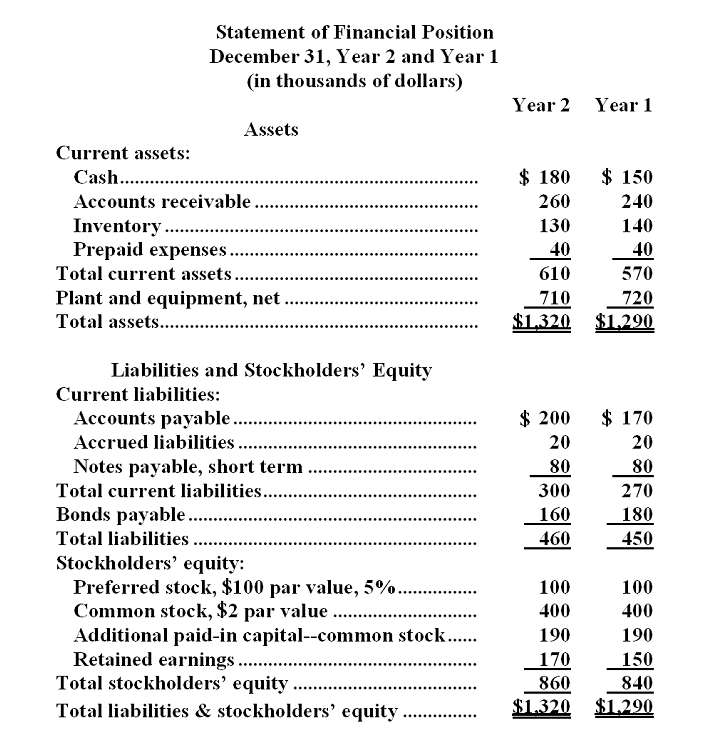

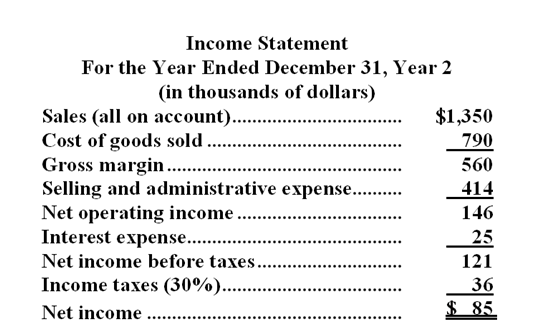

Hartzog Corporation's most recent balance sheet and income statement appear below:

Dividends on common stock during Year 2 totaled $60 thousand. Dividends on preferred stock totaled $5 thousand. The market price of common stock at the end of Year 2 was $7.04 per share.

Dividends on common stock during Year 2 totaled $60 thousand. Dividends on preferred stock totaled $5 thousand. The market price of common stock at the end of Year 2 was $7.04 per share.

-The dividend payout ratio for Year 2 is closest to:

Definitions:

EMH

The Efficient Market Hypothesis, which states that share prices reflect all available information and are thus accurately priced.

Relevant Information

Data or facts that can influence decisions because they are pertinent and directly related to the issue at hand.

Fundamental Analysis

Fundamental analysis involves examining a company's financial statements, health, competitive position, and market trends to gauge its stock's value.

Mispriced Stocks

Stocks whose market prices do not accurately reflect their intrinsic values, potentially due to market inefficiencies or information asymmetry.

Q4: The function <span class="ql-formula" data-value="f(x)=\sqrt{5+c

Q22: Find the limit. <span class="ql-formula"

Q23: Use a graph to find a

Q25: (Ignore income taxes in this problem. )An

Q41: Evaluate the limit, if it exists.

Q60: Find the limit. <span class="ql-formula"

Q80: Scientists have discovered that a linear

Q107: One criticism of the payback method is

Q162: Harwich Company's debt-to-equity ratio at the end

Q189: Marcell Company's inventory turnover for Year 2