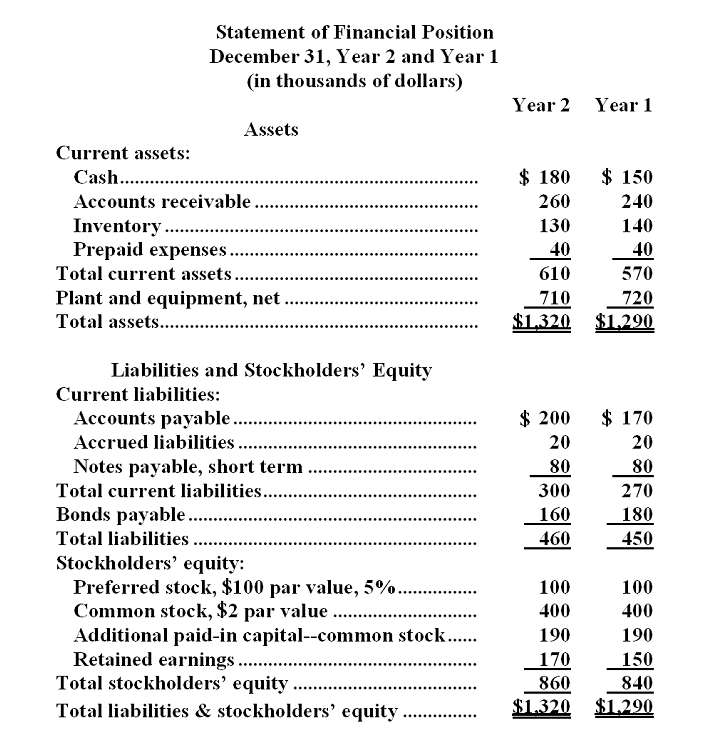

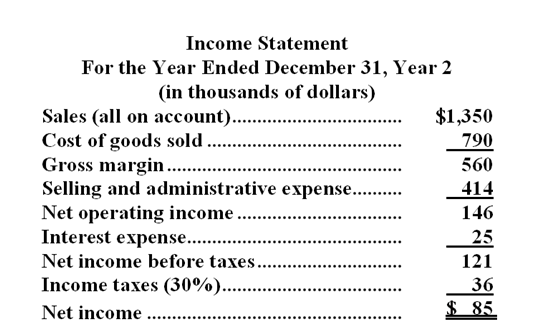

Hartzog Corporation's most recent balance sheet and income statement appear below:

Dividends on common stock during Year 2 totaled $60 thousand. Dividends on preferred stock totaled $5 thousand. The market price of common stock at the end of Year 2 was $7.04 per share.

Dividends on common stock during Year 2 totaled $60 thousand. Dividends on preferred stock totaled $5 thousand. The market price of common stock at the end of Year 2 was $7.04 per share.

-The debt-to-equity ratio at the end of Year 2 is closest to:

Definitions:

Public Interest

The welfare or well-being of the general public, often considered in decision-making processes to ensure decisions benefit the majority.

Promotionally Motivated

Describes actions or strategies driven by the desire to promote or market a product, service, or brand to increase visibility and sales.

Corporate Social Responsibility

A company's commitment to managing the social, environmental, and economic effects of its operations responsibly and in line with public expectations.

Strategies

Carefully designed plans or methods aimed at achieving specific goals or objectives, often within business, military, or personal contexts.

Q12: Differentiate. <span class="ql-formula" data-value="y=\frac{\sin x}{3+\cos

Q33: The net cash provided by (used in)investing

Q45: Graph the function by hand, not

Q60: A rectangle has perimeter 14 m.

Q63: Find the exact value of the

Q64: Find <span class="ql-formula" data-value="d^{2} y

Q68: Use the table to estimate the

Q84: The symbol <span class="ql-formula" data-value="\lfloor\rfloor"><span

Q98: If the discount rate is 11%,the net

Q207: Financial statements for Qualle Company appear below: