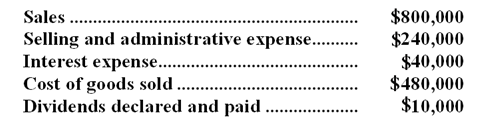

Selected financial data from Osterville Company for the most recent year appear below:  The income tax rate is 40%.

The income tax rate is 40%.

-Net income as a percentage of sales was:

Definitions:

Current Ratio

A measure used to evaluate a company’s liquidity and short-term debt-paying ability; computed by dividing current assets by current liabilities.

Vertical Analysis

A financial statement analysis method where each entry for each category is listed as a percentage of a base figure within the statement.

Horizontal Analysis

A financial analysis technique that compares line items in financial statements over different periods to identify trends.

Horizontal Analysis

Horizontal analysis is a financial analysis technique that compares historical financial data over a series of periods.

Q1: Based solely on the information above,the net

Q11: Hannah Corporation's comparative balance sheet appears below:

Q17: When a company invests in equipment,it gets

Q17: Estimate the value of the following

Q17: Moren Corporation's net cash provided by operating

Q39: The free cash flow for the year

Q53: Paying taxes to governmental bodies is considered

Q56: The market price of XYZ Company's common

Q151: The quantity Q of charge in

Q202: The return on total assets for Year