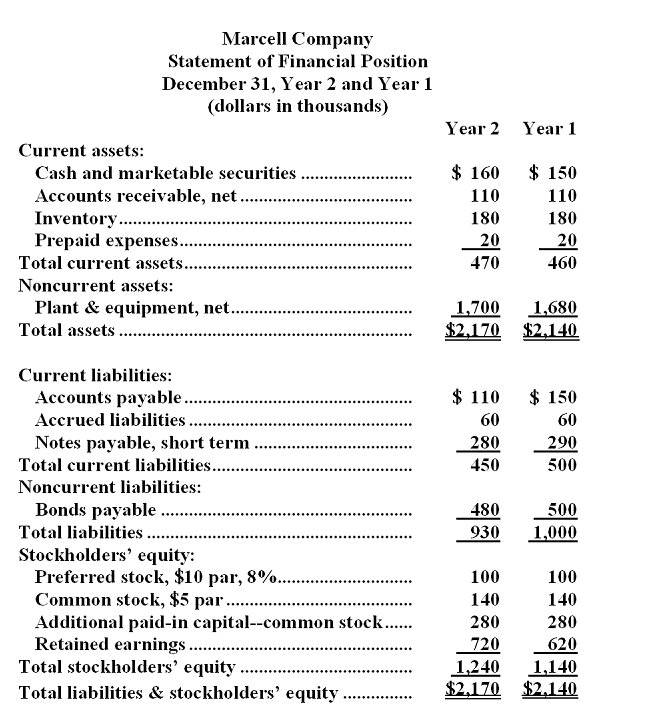

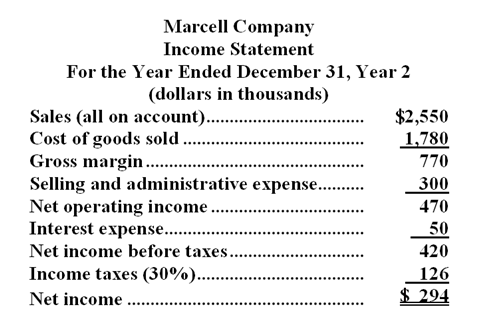

Financial statements for Marcell Company appear below:

-Marcell Company's average sale period for Year 2 was closest to:

Definitions:

Realized Gain

The profit made from the sale of an asset or investment when it is actually sold, not just on paper.

Available-for-sale Securities

Financial assets that are intended to be sold before they reach maturity or are needed to fund specific obligations.

Interest Revenue

Income earned on investments, loans, and other interest-bearing financial instruments, recorded as revenue in the income statement.

Debt Trading Securities

Financial instruments that involve debt and are actively bought and sold on markets with the aim to profit from price movements.

Q4: Orange Company's current ratio at the end

Q22: Gorovitz Corporation's most recent balance sheet appears

Q62: (Ignore income taxes in this problem. )Tu

Q66: The net present value on this investment

Q75: A telephone line hangs between two

Q98: A company can have a net loss

Q100: The payback period for the investment is

Q174: Erastic Company has $14,000 in cash,$8,000 in

Q186: Marcell Company's acid-test ratio at the end

Q188: When computing the acid-test ratio,a short-term note