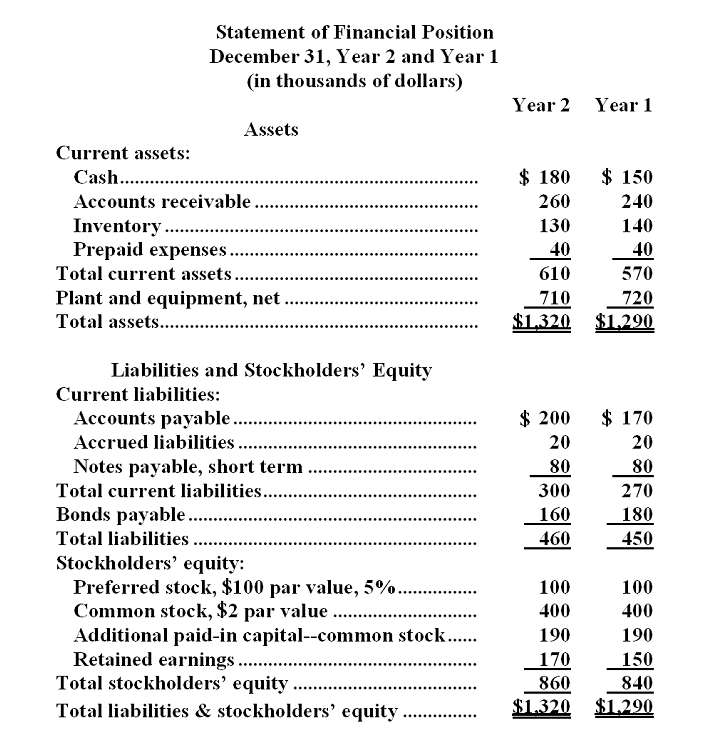

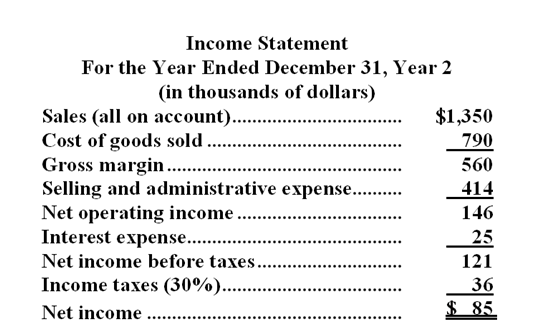

Hartzog Corporation's most recent balance sheet and income statement appear below:

Dividends on common stock during Year 2 totaled $60 thousand. Dividends on preferred stock totaled $5 thousand. The market price of common stock at the end of Year 2 was $7.04 per share.

Dividends on common stock during Year 2 totaled $60 thousand. Dividends on preferred stock totaled $5 thousand. The market price of common stock at the end of Year 2 was $7.04 per share.

-The book value per share at the end of Year 2 is closest to:

Definitions:

Foreign Direct Investment

An investment made by a company or individual in one country in business interests in another country, in the form of establishing business operations or acquiring business assets.

Largest Net Recipient

A term typically used in finance and trade, referring to the entity or country that receives more resources, money, or benefits than it provides or contributes.

China

China is a country in East Asia, known for being the world's most populous country and having one of the oldest civilizations. It has a mixed socialist market economy and is a major player in global affairs.

Trickle-Down Theory

The assertion that stimulating overall economic growth will ultimately help the poor.

Q21: Find the derivative of the function.

Q23: If new equipment is replacing old equipment,any

Q25: At what point is the function

Q27: The graph of the function

Q49: Write an equation that expresses the fact

Q61: Generally,a product line should be dropped when

Q93: Plot the graph of the function

Q108: Which of the following would be considered

Q134: Use the definition of the derivative

Q139: The function <span class="ql-formula" data-value="f(x)=8