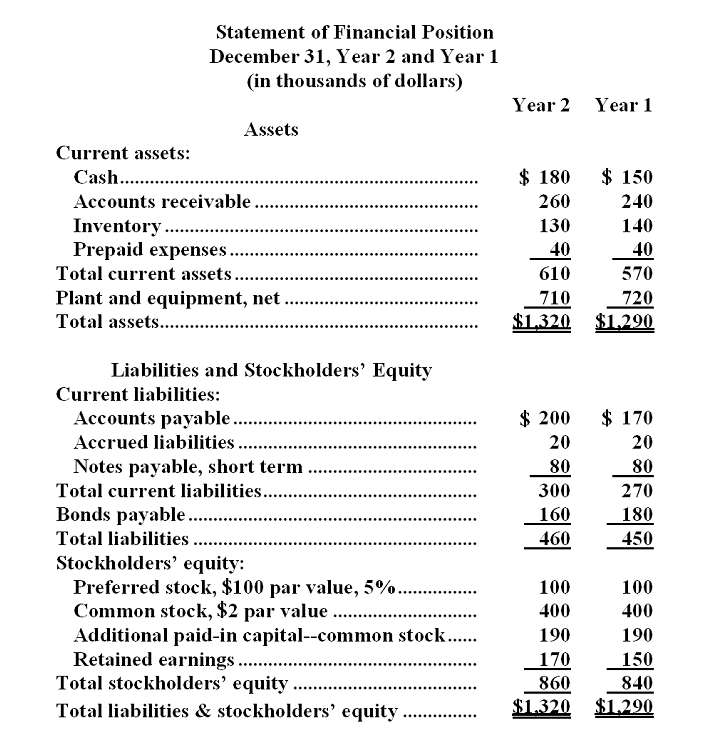

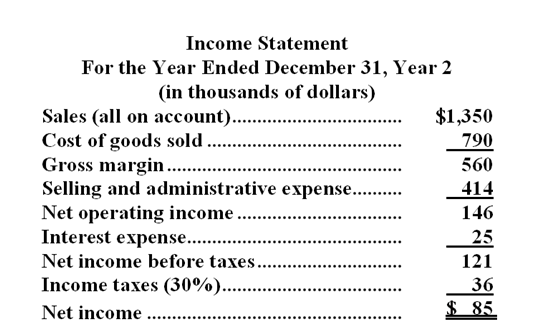

Hartzog Corporation's most recent balance sheet and income statement appear below:

Dividends on common stock during Year 2 totaled $60 thousand. Dividends on preferred stock totaled $5 thousand. The market price of common stock at the end of Year 2 was $7.04 per share.

Dividends on common stock during Year 2 totaled $60 thousand. Dividends on preferred stock totaled $5 thousand. The market price of common stock at the end of Year 2 was $7.04 per share.

-The accounts receivable turnover for Year 2 is closest to:

Definitions:

GM Stock

Equity shares issued by General Motors Company, representing ownership interests in the automaker.

Portfolio

A collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including mutual funds and ETFs.

Security Market Line

A graphical representation of the expected return of investments as a function of their risk, showing how different levels of risk correlate with the market's rate of return.

Risk Premium

The extra return above the risk-free rate that investors require as compensation for the higher risk of investing in a particular asset.

Q5: The internal rate of return for this

Q12: Find the limit. <span class="ql-formula"

Q20: Ignoring the annual benefit,to the nearest whole

Q42: The position of a car is

Q47: Arcade Corporation's balance sheet and income statement

Q65: Find a formula for the inverse

Q70: How many real roots does the

Q84: In a statement of cash flows,all of

Q108: Verify that the function satisfies the

Q148: The equation of motion is given