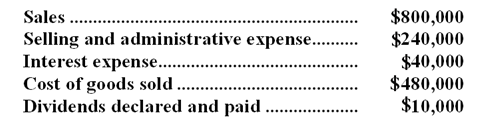

Selected financial data from Osterville Company for the most recent year appear below:  The income tax rate is 40%.

The income tax rate is 40%.

-Net operating income as a percentage of sales was:

Definitions:

Generates Revenue

Activities or processes that result in the earning of income for a business through the sale of goods or services.

Incurs Costs

To undergo or suffer expenses during the execution of activities or operations.

Profit Center

A business segment or department within an organization that is responsible for generating its own revenue and thereby directly impacting profitability.

Responsibility Center

A department or unit within an organization that is accountable for specific activities and performance, with its performance measured against planned objectives.

Q4: Find the derivative of the function.

Q9: The current ratio at the end of

Q28: The earnings per share of common stock

Q38: The dividend payout ratio for Year 2

Q55: Find the value of the expression accurate

Q82: Find an expression for the function

Q90: If <span class="ql-formula" data-value="f(x)=6 \cos

Q123: Guedea Corporation's most recent balance sheet and

Q159: Last year,Bickham Corporation's dividend on common stock

Q210: The dividend yield ratio for Year 2