Renbud Computer Services Co.(RCS)specializes in customized software development for the broadcast and telecommunications industries.The company was started by three people in 1973 to develop software primarily for a national network to be used in broadcasting national election results.After sustained and manageable growth for many years,the company has grown very fast over the last three years,doubling in size.

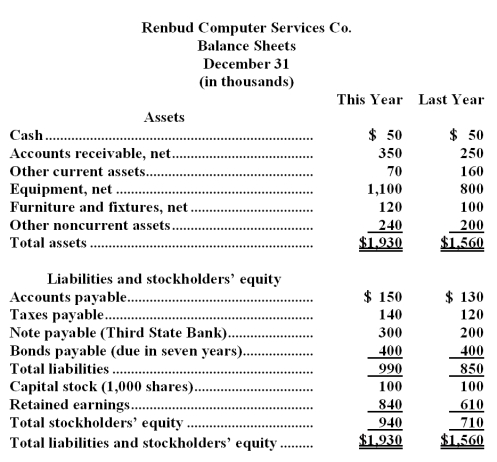

This growth has placed the company in a challenging financial position.Within thirty days,RCS will need to renew its $300,000 loan with the Third State Bank of San Marcos.This loan is classified as a current liability on RCS's balance sheet.Harvey Renbud,president of RCS,is concerned about renewing the loan.The bank has requested RCS's most recent financial statements which appear below,including balance sheets for this year and last year.The bank has also requested four ratios relating to operating performance and liquidity. Renbud Computer Services Co.

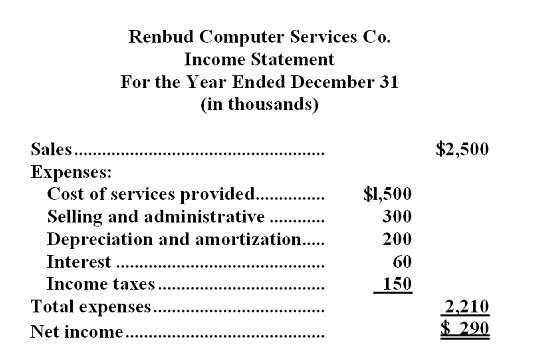

Income Statement

For the Year Ended December 31

(in thousands)

Required:

Required:

a.Explain why the Third State Bank of San Marcos would be interested in reviewing Renbud Computer Services Co.'s comparative financial statements and its financial ratios before renewing the loan.

b.Calculate the following financial ratios for Renbud Computer Services Co.:

1.The current ratio for both this year and last year.

2.Accounts receivable turnover for this year.

3.Return on common stockholders' equity for this year.

4.The debt-to-equity ratio for both this year and last year.

c.Discuss briefly the limitations and difficulties that can be encountered in using ratio analysis.

Definitions:

Scatter Diagram

A graphical representation used to visualize the relationship between two quantitative variables, showing how one variable affects the other.

Q26: Use the definition of the limit

Q35: Find the first and the second

Q41: The price-earnings ratio for Year 2 is

Q50: Ethridge Corporation is presently making part H25

Q53: (Ignore income taxes in this problem. )Mercredi,Inc.

Q69: Based solely on the information above,the net

Q105: If Varone can expect to sell 32,000

Q143: All debt is considered in the computation

Q154: The acid-test ratio at the end of

Q162: Harwich Company's debt-to-equity ratio at the end