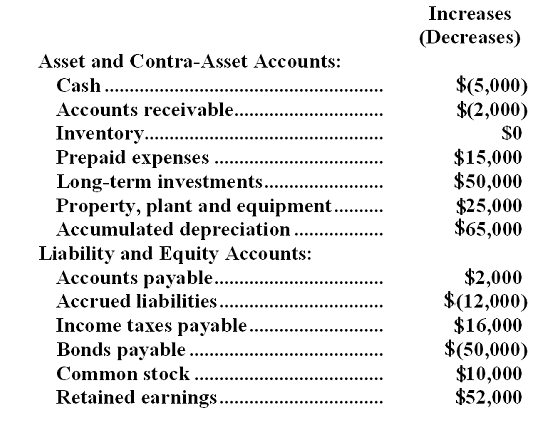

The changes in Tener Company's balance sheet account balances for last year appear below:  The company's income statement for the year appears below:

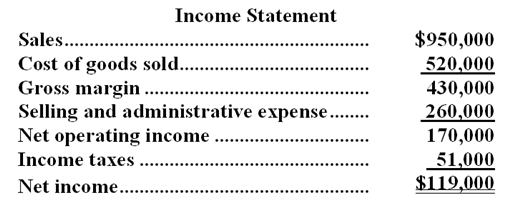

The company's income statement for the year appears below:  The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

The company declared and paid $67,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by operating activities.

-On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

Definitions:

Dollar Sales

The total revenue generated from goods or services sold, measured in dollar value.

Break-Even

The situation where overall costs are equivalent to overall revenues, resulting in neither gains nor losses.

Monthly

Referring to something that occurs, is measured, or is paid every month.

Dollar Sales

Total revenue generated from the sale of goods or services, expressed in dollars.

Q15: Find an equation of the tangent

Q28: The net cash provided by (used in)financing

Q32: What would be the effect on the

Q47: (Ignore income taxes in this problem. )The

Q58: Find <span class="ql-formula" data-value="f^{-1}"><span class="katex"><span

Q68: (Ignore income taxes in this problem. )Duhl

Q86: (Ignore income taxes in this problem. )The

Q89: The Hayes Company manufactures and sells several

Q98: Selected year-end data for the Brayer

Q105: If Varone can expect to sell 32,000