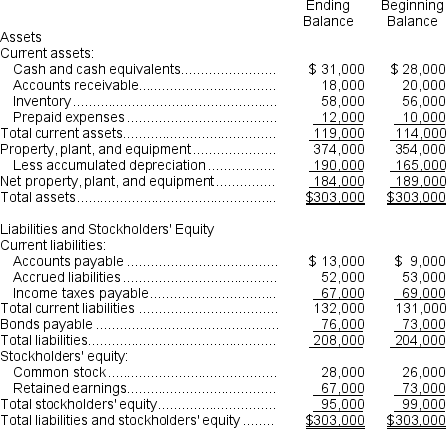

Krech Corporation's comparative balance sheet appears below:

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities.

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities.

-Which of the following is correct regarding the operating activities section of the statement of cash flows?

Definitions:

Frequency of Payouts

Refers to how often employees receive their earnings, such as weekly, bi-weekly, monthly, or quarterly.

Bonus Allocation

is the distribution of financial rewards to employees beyond their regular pay, typically based on performance or company profit.

Gain Sharing

A performance-related pay strategy that offers employees financial rewards based on improvements in productivity, efficiency, or profitability within their work group or organization.

Higher Performers

Employees who consistently exceed job expectations and perform at levels beyond their peers.

Q14: A transfer price is the price charged

Q25: Leslie Company operates a cafeteria for the

Q31: On the statement of cash flows,the sales

Q71: (Ignore income taxes in this problem. )The

Q73: Jumonville Company produces a single product.The cost

Q84: The symbol <span class="ql-formula" data-value="\lfloor\rfloor"><span

Q90: Managers should not authorize working overtime at

Q97: If the internal rate of return is

Q179: Hagerman Corporation's most recent income statement appears

Q187: Assuming stable business conditions,an increase in the