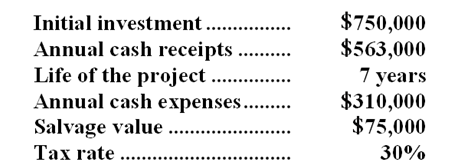

Burry Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 11%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 11%.

-When computing the net present value of the project,what are the annual after-tax cash receipts?

Definitions:

Allocative Efficiency

A state of resource allocation where resources are distributed according to consumer preferences, leading to optimal production levels and pricing.

Corrective Tax

A tax designed to encourage private decision makers to take into account the social costs that arise from a negative externality.

Allocative Efficiency

A state where resources are allocated in a way that maximizes the net benefit to society, with products being produced at a quantity where the price equals marginal cost.

Consumer Surplus

The contrast between the total payment consumers are willing and financially able to make for a good or service and the amount they truly pay.

Q7: The net cash provided by (used in)investing

Q8: If the internal rate of return exceeds

Q16: A favorable labor rate variance is recorded

Q21: When computing the net present value of

Q37: The net cash provided by (used in)investing

Q37: The performance measures on a balanced scorecard

Q72: Find the inverse function of

Q88: The relationship between the Fahrenheit and

Q120: The price-earnings ratio for Year 2 is

Q140: (Ignore income taxes in this problem)Lett Corporation