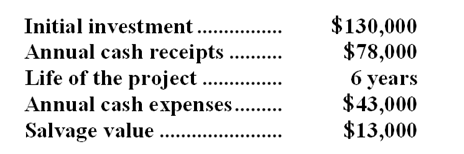

Morgado Inc. has provided the following data to be used in evaluating a proposed investment project:  The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 5 years without any reduction for salvage value. The company uses a discount rate of 19%.

The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 5 years without any reduction for salvage value. The company uses a discount rate of 19%.

-When computing the net present value of the project,what are the annual after-tax cash receipts?

Definitions:

Real Rate of Interest

The yield a investor foresees receiving, once inflation adjustments are made.

Term Structure

The term structure represents the relationship between the interest rates and the different maturities of debt securities, often depicted in the form of a yield curve.

Junk Bonds

High-risk and high-yield bonds rated below investment grade by credit rating agencies.

Subordinated Debt

A class of debt which ranks below other debts with regard to claims on assets or earnings.

Q2: The accounts receivable turnover for Year 2

Q3: A general rule in relevant cost analysis

Q6: The variable costs of service departments should

Q13: Division X has asked Division K of

Q21: When computing the net present value of

Q27: Which of the intermediate products should be

Q46: Find the exact value of the

Q156: Financial statements for Rarig Company appear below:

Q204: Archer Company had net income of $40,000

Q210: The dividend yield ratio for Year 2