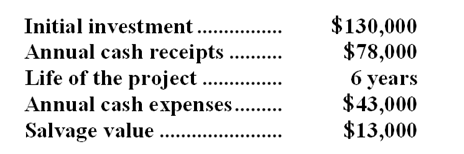

Morgado Inc. has provided the following data to be used in evaluating a proposed investment project:  The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 5 years without any reduction for salvage value. The company uses a discount rate of 19%.

The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 5 years without any reduction for salvage value. The company uses a discount rate of 19%.

-By how much does the depreciation deduction reduce taxes each year in which the depreciation deduction is taken?

Definitions:

Collateral

An asset pledged by a borrower to secure a loan, subject to seizure in the event of default.

Secured Party

A secured party refers to an individual or entity that holds an interest in the secured property, typically as collateral, to secure payment or performance of an obligation.

Bankruptcy Law

A legal process through which individuals or entities unable to meet their financial obligations can seek relief from some or all of their debts.

Documents of Title

Legal documents that provide proof of ownership of property, such as bills of lading or warehouse receipts.

Q1: The division's residual income is closest to:<br>A)$575,100<br>B)$1,175,100<br>C)$(1,980,900)<br>D)$(24,900)

Q5: The following events occurred last year at

Q8: Odle Company purchased material on account.The entry

Q12: An investment project for which the net

Q37: The performance measures on a balanced scorecard

Q73: Starting with the graph of

Q81: The current ratio at the end of

Q87: If two projects require the same amount

Q108: Which of the following would be considered

Q113: Preference decisions attempt to determine which of