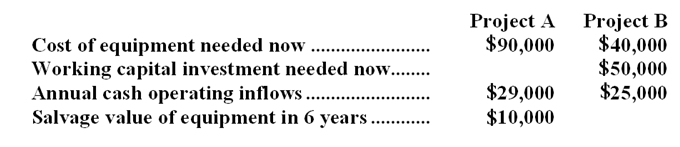

(Ignore income taxes in this problem.) Rushforth Manufacturing has $90,000 to invest in either Project A or Project B. The following data are available on these projects:  Both projects will have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Rushforth's required rate of return is 14%.

Both projects will have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Rushforth's required rate of return is 14%.

-The net present value of Project A is:

Definitions:

Synergy

The interaction or cooperation of two or more organizations, substances, or other agents to produce a combined effect greater than the sum of their separate effects.

GLOBE Project

A research initiative that examines the impact of culture on leadership effectiveness and organizational success worldwide.

Cultural Dimensions

Aspects of cultures that can be measured relative to other cultures, often used in social sciences to compare and contrast cultural norms and values.

Practices And Values

The established methods, traditions, and principles that guide behavior, decision-making, and interactions within a particular group or organization.

Q4: When computing the net present value of

Q16: Condensed financial statements for Pardin Company are

Q18: Division B had an ROI last year

Q35: Depreciation expense on existing factory equipment is

Q38: On the statement of cash flows,the cost

Q43: According to the company's accounting system,what is

Q64: A company's current ratio and acid-test ratios

Q87: Kramer Company makes 4,000 units per year

Q103: A company can increase its net cash

Q137: Data from Ankeny Corporation's most recent