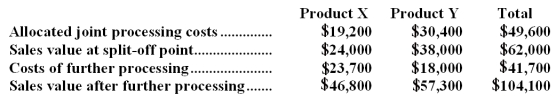

Iaukea Company makes two products from a common input.Joint processing costs up to the split-off point total $49,600 a year.The company allocates these costs to the joint products on the basis of their total sales values at the split-off point.Each product may be sold at the split-off point or processed further.Data concerning these products appear below: Required:

Required:

a.What is the net monetary advantage (disadvantage)of processing Product X beyond the split-off point?

b.What is the net monetary advantage (disadvantage)of processing Product Y beyond the split-off point?

c.What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d.What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Definitions:

Operational Efficiency

The capability of an organization to deliver products or services to its customers in the most cost-effective manner without sacrificing quality.

Voter Support

The backing or approval expressed by citizens for political candidates, parties, or policies through voting.

Profit Motive

The driving force behind business activities aimed at generating profits.

Q4: The investing and financing sections of the

Q11: The net cash provided (used)by operating activities

Q34: Sultzer Corporation applies manufacturing overhead to products

Q60: The dividend payout ratio for Year 2

Q67: The working capital at the end of

Q76: Wright Company produces products I,J,and K from

Q105: The change in the cash balance must

Q119: Suppose there is ample idle capacity to

Q130: Prevatte Corporation purchases potatoes from farmers.The potatoes

Q193: Marcell Company's average collection period for Year