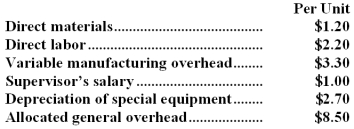

Part I51 is used in one of Pries Corporation's products.The company makes 18,000 units of this part each year.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce this part and sell it to the company for $15.80 each.If this offer is accepted,the supervisor's salary and all of the variable costs,including direct labor,can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted,only $26,000 of these allocated general overhead costs would be avoided. If management decides to buy part I51 from the outside supplier rather than to continue making the part,what would be the annual impact on the company's overall net operating income?

An outside supplier has offered to produce this part and sell it to the company for $15.80 each.If this offer is accepted,the supervisor's salary and all of the variable costs,including direct labor,can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted,only $26,000 of these allocated general overhead costs would be avoided. If management decides to buy part I51 from the outside supplier rather than to continue making the part,what would be the annual impact on the company's overall net operating income?

Definitions:

Risk

The possibility of loss, damage, or an adverse outcome from an action or event.

Sale of Goods

Refers to the transaction of purchasing and selling tangible personal property.

Risk

The potential for losing something of value, either physically, financially, or emotionally, due to a particular action or event.

C.I.F. Contract

Stands for "Cost, Insurance, and Freight," a type of international shipping agreement where the seller pays for the cost of goods, insurance, and freight to a specified destination.

Q20: Bennett Company reported sales on its income

Q34: The management of Heider Corporation is considering

Q59: What was the West Division's residual income

Q81: The current ratio at the end of

Q106: The constraint at Vrana Inc.is an expensive

Q116: Part N29 is used by Farman Corporation

Q130: Millage Corporation has provided the following

Q130: The materials price variance for October is:<br>A)$620

Q176: Larned Company's price-earnings ratio on December 31,Year

Q182: The dividend yield ratio for Year 2