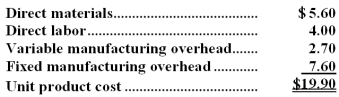

A customer has requested that Inga Corporation fill a special order for 2,000 units of product K81 for $25.00 a unit.While the product would be modified slightly for the special order,product K81's normal unit product cost is $19.90:  Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like modifications made to product K81 that would increase the variable costs by $1.20 per unit and that would require an investment of $10,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.If the special order is accepted,the company's overall net operating income would increase (decrease) by:

Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like modifications made to product K81 that would increase the variable costs by $1.20 per unit and that would require an investment of $10,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.If the special order is accepted,the company's overall net operating income would increase (decrease) by:

Definitions:

Direct Labor Hours

The total hours worked by employees who directly participate in the production of goods detailed.

ABC

A costing method that identifies activities in an organization and assigns the cost of each activity to products or services according to the actual consumption.

Overhead Costing Systems

Methodologies used to allocate indirect costs (overhead) to products or services, which may vary depending on the costing approach (e.g., traditional costing or activity-based costing).

Overhead Allocation Base

A metric used to assign indirect costs to cost objects, often based on time, labor, or machine hours.

Q6: Ring Corporation uses a discount rate of

Q15: Assume that the Milk Chocolate Division is

Q38: On the statement of cash flows,the cost

Q39: Carlton Company reported on its income statement

Q44: The net cash provided (used)by financing activities

Q83: The manufacturing cycle efficiency (MCE)for this operation

Q87: The manufacturing cycle efficiency (MCE)was closest to:<br>A)0.17<br>B)0.05<br>C)0.43<br>D)0.19

Q114: Mr.Earl Pearl,accountant for Margie Knall Co. ,Inc.

Q126: Liffick Corporation is a specialty component manufacturer

Q152: Lampshire Inc.is considering using stocks of an