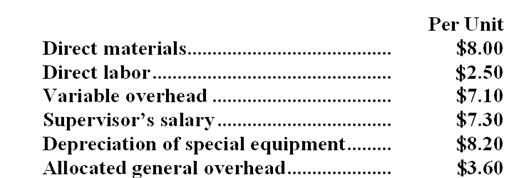

Knaack Corporation is presently making part R20 that is used in one of its products. A total of 18,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $27.70 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

An outside supplier has offered to produce and sell the part to the company for $27.70 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

-If management decides to buy part R20 from the outside supplier rather than to continue making the part,what would be the annual impact on the company's overall net operating income?

Definitions:

Own Price Elasticity

Own price elasticity measures the responsiveness of the quantity demanded of a good to a change in its own price.

Market Share

The percentage of an industry's total sales that is earned by a particular company over a specified time period.

Demand

The quantity of a good or service that consumers are willing and able to purchase at various prices during a given period.

Gas Station

A facility where gasoline (petrol) and often other fuels and automotive products are sold to motorists.

Q2: For performance evaluation purposes,variable costs of service

Q16: If Meacham decides to purchase the subcomponent

Q26: Average operating assets in Year 1 were:<br>A)$160,000<br>B)$150,000<br>C)$125,000<br>D)$100,000

Q30: A company has a standard cost system

Q42: The average operating assets in Year 2

Q46: Which of the following are valid reasons

Q54: If the new equipment is purchased,the present

Q55: How much profit (loss)does the company make

Q58: Jerston Company has an annual plant capacity

Q196: Financial statements for Pracht Company appear below: