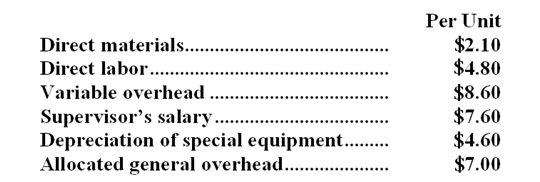

Meltzer Corporation is presently making part O13 that is used in one of its products. A total of 3,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $27.00 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $3,000 of these allocated general overhead costs would be avoided.

An outside supplier has offered to produce and sell the part to the company for $27.00 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $3,000 of these allocated general overhead costs would be avoided.

-In addition to the facts given above,assume that the space used to produce part O13 could be used to make more of one of the company's other products,generating an additional segment margin of $26,000 per year for that product.What would be the impact on the company's overall net operating income of buying part O13 from the outside supplier and using the freed space to make more of the other product?

Definitions:

Security Deposit

A sum of money held in trust either as an initial part-payment in a purchasing process or as a guarantee for the performance of a specified action.

Broker's Fee

A fee charged by a broker for executing transactions or providing specialized services.

Lease Protection

A plan or policy that covers potential damage or excessive wear and tear on a leased vehicle beyond what is considered normal.

Amortization Table

A complete schedule of periodic blended loan payments, showing the amount of principal and the amount of interest that comprise each payment so that the loan will be paid off at the end of its term.

Q2: If Talboe chooses to buy the wheel

Q2: Rank the projects according to the profitability

Q30: Block Corporation makes three products that use

Q53: Paying taxes to governmental bodies is considered

Q56: What is the predetermined overhead rate to

Q64: The throughput time was:<br>A)9.3 hours<br>B)4.9 hours<br>C)30.9 hours<br>D)26

Q100: The payback period for the investment is

Q116: Perkins Company is considering several investment proposals,as

Q195: Basta Corporation's net income last year was

Q198: The inventory turnover for Year 2 is