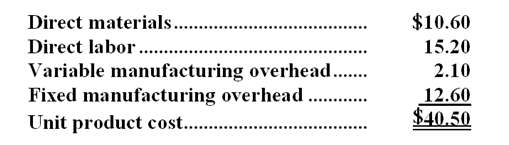

Ahsan Company makes 60,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:  An outside supplier has offered to sell the company all of these parts it needs for $45.70 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $318,000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $45.70 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $318,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $3.50 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

-What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 60,000 units required each year?

Definitions:

Majority Sign-up

A method for workers to form a union or gain union representation by obtaining the signatures of a majority of employees in a bargaining unit, bypassing the need for a formal election.

Decertify Union

The process by which workers can remove the certification of their union as the bargaining representative, typically through a vote.

Eligible Employees

Workers who meet certain criteria set by employers or laws that allow them to receive benefits or rights, such as participating in a union.

NLRB Representation Election

A voting process overseen by the National Labor Relations Board where employees decide whether to be represented by a union.

Q3: Moralez Corporation has a standard cost system

Q7: The materials price variance for March is:<br>A)$860

Q26: Last year the sales at Summit Company

Q29: Which product makes the MOST profitable use

Q43: In August,the Universal Solutions Division of Jugan

Q63: How much profit (loss)does the company make

Q67: The following standards for variable manufacturing overhead

Q126: (Ignore income taxes in this problem. )The

Q138: Iaukea Company makes two products from a

Q174: The materials price variance is:<br>A)$400 U<br>B)$400 F<br>C)$600