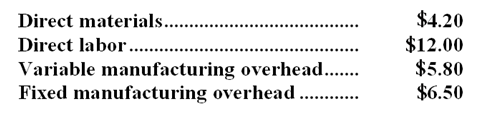

The Rodgers Company makes 27,000 units of a certain component each year for use in one of its products. The cost per unit for the component at this level of activity is as follows:  Rodgers has received an offer from an outside supplier who is willing to provide 27,000 units of this component each year at a price of $25 per component. Assume that direct labor is a variable cost. None of the fixed manufacturing overhead would be avoidable if this component were purchased from the outside supplier.

Rodgers has received an offer from an outside supplier who is willing to provide 27,000 units of this component each year at a price of $25 per component. Assume that direct labor is a variable cost. None of the fixed manufacturing overhead would be avoidable if this component were purchased from the outside supplier.

-Assume that if the component is purchased from the outside supplier,$35,100 of annual fixed manufacturing overhead would be avoided and the facilities now being used to make the component would be rented to another company for $64,800 per year.If Rodgers chooses to buy the component from the outside supplier under these circumstances,then the impact on annual net operating income due to accepting the offer would be:

Definitions:

Distributive Bargaining

A negotiation strategy focused on dividing a fixed amount of resources or benefits, where any gain by one party is at the expense of another.

Integrative Bargaining

A negotiation strategy where all parties collaborate to find a win-win solution that provides mutual benefit.

Creative Solutions

Original and innovative responses or approaches formulated to address problems or challenges.

Bargaining and Problem Solving

A method of conflict resolution that involves negotiation and creative thinking to arrive at mutually beneficial solutions.

Q8: At the end of the year,actual manufacturing

Q9: A decrease in the discount rate:<br>A)will increase

Q9: When a division is operating at full

Q80: If the denominator level of activity is

Q100: The direct materials price variance for May

Q105: Franklin's fixed manufacturing overhead volume variance for

Q112: (Ignore income taxes in this problem. )The

Q120: The net present value of the proposed

Q144: The standard cost card for a product

Q207: Financial statements for Qualle Company appear below: