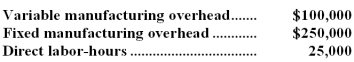

Bady Inc.makes a range of products.The company's predetermined overhead rate is $14 per direct labor-hour,which was calculated using the following budgeted data:  Component M3 is used in one of the company's products.The unit cost of the component according to the company's cost accounting system is determined as follows:

Component M3 is used in one of the company's products.The unit cost of the component according to the company's cost accounting system is determined as follows:  An outside supplier has offered to supply component M3 for $108 each.The outside supplier is known for quality and reliability.Assume that direct labor is a variable cost,variable manufacturing overhead is really driven by direct labor-hours,and total fixed manufacturing overhead would not be affected by this decision.Bady chronically has idle capacity.

An outside supplier has offered to supply component M3 for $108 each.The outside supplier is known for quality and reliability.Assume that direct labor is a variable cost,variable manufacturing overhead is really driven by direct labor-hours,and total fixed manufacturing overhead would not be affected by this decision.Bady chronically has idle capacity.

Required:

Is the offer from the outside supplier financially attractive? Why?

Definitions:

Foreign Branch Plant

A subsidiary production or service facility of a company located in another country from the parent company.

Foreign Distribution Agreement

A legal contract between entities based in different countries for the distribution of goods or services.

Joint Venture Agreement

A legal document that outlines the terms and conditions under which two or more parties undertake a specific business venture together.

Q3: The net cash provided by (used in)financing

Q9: Fixed service department costs should be charged

Q12: What was the fixed manufacturing overhead volume

Q16: A gain on the sale of equipment

Q26: The net cash provided by (used in)operating

Q111: In general,the purchasing agent is responsible for

Q114: Kornfeld Corporation produces metal telephone poles.In the

Q121: The labor rate variance was:<br>A)$3,900 favorable<br>B)$3,900 unfavorable<br>C)$3,100

Q125: The simple rate of return on the

Q156: If the labor efficiency variance is unfavorable,then<br>A)actual