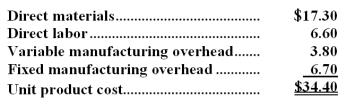

Holtrop Corporation has received a request for a special order of 9,000 units of product Z74 for $46.50 each.The normal selling price of this product is $51.60 each,but the units would need to be modified slightly for the customer.The normal unit product cost of product Z74 is computed as follows:  Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like some modifications made to product Z74 that would increase the variable costs by $6.20 per unit and that would require a one-time investment of $46,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.

Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like some modifications made to product Z74 that would increase the variable costs by $6.20 per unit and that would require a one-time investment of $46,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.

Required:

Determine the effect on the company's total net operating income of accepting the special order.Show your work!

Definitions:

Long-run Supply Curve

A graphical representation showing the relationship between the price level and the quantity of output that producers are willing to supply, taking into account all factors of production can be varied.

Profitable Output

The production or output level from a business operation that generates a financial gain or profit.

Firm

An organization engaged in commercial, industrial, or professional activities, typically with the aim of earning a profit.

Long-Run Supply Curve

A graphical representation showing the relationship between the price of a good and the quantity supplied over a period when all factors of production can vary.

Q3: Consider a company that has only variable

Q7: The following information is taken from the

Q20: The division's return on investment (ROI)is closest

Q49: What is the net monetary advantage (disadvantage)of

Q58: Based solely on the information above,the net

Q59: The following labor standards have been established

Q60: (Ignore income taxes in this problem. )Rogers

Q66: The standard variable overhead rate per machine

Q131: The following direct labor standards have been

Q137: If the new product is added next