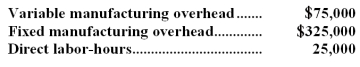

Humes Corporation makes a range of products.The company's predetermined overhead rate is $16 per direct labor-hour,which was calculated using the following budgeted data:  Management is considering a special order for 700 units of product J45K at $64 each.The normal selling price of product J45K is $75 and the unit product cost is determined as follows:

Management is considering a special order for 700 units of product J45K at $64 each.The normal selling price of product J45K is $75 and the unit product cost is determined as follows:  If the special order were accepted,normal sales of this and other products would not be affected.The company has ample excess capacity to produce the additional units.Assume that direct labor is a variable cost,variable manufacturing overhead is really driven by direct labor-hours,and total fixed manufacturing overhead would not be affected by the special order.

If the special order were accepted,normal sales of this and other products would not be affected.The company has ample excess capacity to produce the additional units.Assume that direct labor is a variable cost,variable manufacturing overhead is really driven by direct labor-hours,and total fixed manufacturing overhead would not be affected by the special order.

Required:

If the special order were accepted,what would be the impact on the company's overall profit?

Definitions:

Q2: The most recent balance sheet and income

Q8: The net cash provided by (used in)financing

Q13: Depreciation expense reduces income taxes by an

Q14: The net cash provided by (used in)investing

Q24: Sommers Fabrication Corporation has a standard cost

Q25: The fixed manufacturing overhead budget variance is

Q28: Which of the following is not an

Q48: Sales and average operating assets for Company

Q110: (Ignore income taxes in this problem. )If

Q148: If by dropping a product a firm