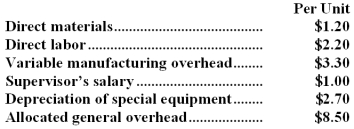

Part I51 is used in one of Pries Corporation's products.The company makes 18,000 units of this part each year.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce this part and sell it to the company for $15.80 each.If this offer is accepted,the supervisor's salary and all of the variable costs,including direct labor,can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted,only $26,000 of these allocated general overhead costs would be avoided. If management decides to buy part I51 from the outside supplier rather than to continue making the part,what would be the annual impact on the company's overall net operating income?

An outside supplier has offered to produce this part and sell it to the company for $15.80 each.If this offer is accepted,the supervisor's salary and all of the variable costs,including direct labor,can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted,only $26,000 of these allocated general overhead costs would be avoided. If management decides to buy part I51 from the outside supplier rather than to continue making the part,what would be the annual impact on the company's overall net operating income?

Definitions:

1934 Act

The Securities Exchange Act of 1934, legislation regulating the secondary trading of securities (stocks, bonds, and debentures) in the United States.

Truth in Securities Act

Also known as the Securities Act of 1933, it is a U.S. law aimed at ensuring the transparency of financial statements to protect investors from fraud.

Registration Requirement

A legal stipulation that certain types of activities, businesses, or professions must be registered with a government agency before they can be lawfully conducted or practiced.

Entire Class

A group of securities, assets, or entities that share the same characteristics within a larger set or category, often used in finance and law.

Q6: A materials price variance is favorable if

Q16: Suppose there is ample capacity so that

Q23: What was the variable overhead rate variance

Q25: The net cash provided by (used in)investing

Q30: (Ignore income taxes in this problem. )A

Q42: The average operating assets in Year 2

Q72: For contra-asset accounts,debits are added to the

Q93: Part E43 is used in one of

Q97: If the internal rate of return is

Q112: Power Systems Inc.manufactures jet engines for the