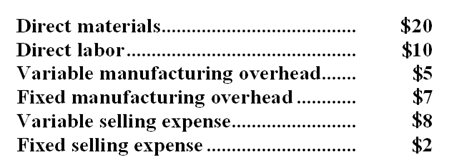

The Varone Company makes a single product called a Hom. The company has the capacity to produce 40,000 Homs per year. Per unit costs to produce and sell one Hom at that activity level are:  The regular selling price for one Hom is $60. A special order has been received at Varone from the Fairview Company to purchase 8,000 Homs next year at 15% off the regular selling price. If this special order were accepted, the variable selling expense would be reduced by 25%. However, Varone would have to purchase a specialized machine to engrave the Fairview name on each Hom in the special order. This machine would cost $12,000 and it would have no use after the special order was filled. The total fixed costs, both manufacturing and selling, are constant within the relevant range of 30,000 to 40,000 Homs per year. Assume direct labor is a variable cost.

The regular selling price for one Hom is $60. A special order has been received at Varone from the Fairview Company to purchase 8,000 Homs next year at 15% off the regular selling price. If this special order were accepted, the variable selling expense would be reduced by 25%. However, Varone would have to purchase a specialized machine to engrave the Fairview name on each Hom in the special order. This machine would cost $12,000 and it would have no use after the special order was filled. The total fixed costs, both manufacturing and selling, are constant within the relevant range of 30,000 to 40,000 Homs per year. Assume direct labor is a variable cost.

-If Varone has an opportunity to sell 37,960 Homs next year through regular channels and the special order is accepted for 15% off the regular selling price,the effect on net operating income next year due to accepting this order would be a:

Definitions:

Solution Implementation

The process of putting a plan or solution into action to solve a problem or achieve a goal.

Decision Making

The process of making choices by identifying a decision, gathering information, and assessing alternative resolutions.

Treatment Rationale

The reasoning or justification behind a specific treatment strategy, explaining why it is considered appropriate or beneficial.

Stress Inoculation

A coping strategy or therapy technique that prepares individuals to handle stressful situations by gradually exposing them to stress.

Q20: The company has received a special,one-time-only order

Q24: The materials quantity variance for November is:<br>A)$9,600

Q26: What is the predetermined overhead rate to

Q30: The net cash provided by (used in)financing

Q32: (Ignore income taxes in this problem)The management

Q36: How much fixed Freight Department costs should

Q57: If the denominator level of activity is

Q99: How much profit (loss)does the company make

Q108: (Ignore income taxes in this problem. )The

Q207: Financial statements for Qualle Company appear below: