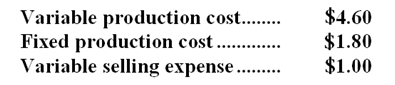

The Immanuel Company has just obtained a request for a special order of 6,000 jigs to be shipped at the end of the month at a selling price of $7 each. The company has a production capacity of 90,000 jigs per month with total fixed production costs of $144,000. At present, the company is selling 80,000 jigs per month through regular channels at a selling price of $11 each. For these regular sales, the cost for one jig is:  If the special order is accepted, Immanuel will not incur any selling expense; however, it will incur shipping costs of $0.30 per unit. Total fixed production cost would not be affected by this order.

If the special order is accepted, Immanuel will not incur any selling expense; however, it will incur shipping costs of $0.30 per unit. Total fixed production cost would not be affected by this order.

-If Immanuel accepts this special order,the change in monthly net operating income will be a:

Definitions:

Exchange Rate

The exchange rate reflecting the value of one currency compared to another.

Spot Exchange Rate

This is the current exchange rate at which two currencies can be exchanged immediately.

Eurocurrency

Currency deposited by national governments or corporations in banks outside their home market, primarily used for lending, borrowing, and investing internationally.

Political Risk

The risk of losing money due to political instability or changes in government policy affecting an investment.

Q2: For performance evaluation purposes,variable costs of service

Q9: The Labor Rate Variance for December would

Q10: Assume that there is no other use

Q11: All other things the same,which of the

Q14: The labor efficiency variance for October is:<br>A)$510

Q32: What would be the effect on the

Q47: Under the direct method,cost of goods sold

Q55: The division's margin is closest to:<br>A)21.8%<br>B)5.0%<br>C)23.0%<br>D)28.0%

Q76: The division's turnover is closest to:<br>A)3.82<br>B)4.26<br>C)0.12<br>D)37.04

Q105: If Varone can expect to sell 32,000