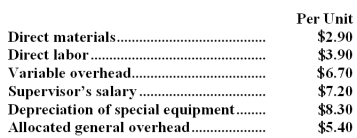

Masse Corporation uses part G18 in one of its products.The company's Accounting Department reports the following costs of producing the 16,000 units of the part that are needed every year.  An outside supplier has offered to make the part and sell it to the company for $28.00 each.If this offer is accepted,the supervisor's salary and all of the variable costs,including direct labor,can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted,only $22,000 of these allocated general overhead costs would be avoided.In addition,the space used to produce part G18 could be used to make more of one of the company's other products,generating an additional segment margin of $22,000 per year for that product.

An outside supplier has offered to make the part and sell it to the company for $28.00 each.If this offer is accepted,the supervisor's salary and all of the variable costs,including direct labor,can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted,only $22,000 of these allocated general overhead costs would be avoided.In addition,the space used to produce part G18 could be used to make more of one of the company's other products,generating an additional segment margin of $22,000 per year for that product.

Required:

a.Prepare a report that shows the effect on the company's total net operating income of buying part G18 from the supplier rather than continuing to make it inside the company.

b.Which alternative should the company choose?

Definitions:

Mourning Rituals

Traditional ceremonies and practices observed in the aftermath of a death, varying widely across cultures, aimed at honoring and remembering the deceased.

Region

A specific geographic area distinguished by certain characteristics such as physical natural features, cultural identity, or administrative boundaries.

Ethnicity

A category of people who identify with each other based on common ancestral, social, cultural, or national experiences.

Sexual Double Standard

A societal code that permits or encourages sexual freedom and experimentation in one gender (typically males) more than the other.

Q1: On the statement of cash flows,the selling

Q19: Gotay Corporation's standard wage rate is $12.00

Q22: In preference decisions,the profitability index and internal

Q30: Block Corporation makes three products that use

Q34: The fixed costs of Baxter Company's personnel

Q36: Eaglen Corporation has provided the following data:

Q44: The sunk cost in this situation is:<br>A)$720,000<br>B)$160,000<br>C)$50,000<br>D)$100,000

Q46: The simple rate of return,to the nearest

Q80: What is the lowest selling price per

Q113: Sunk costs are considered to be avoidable