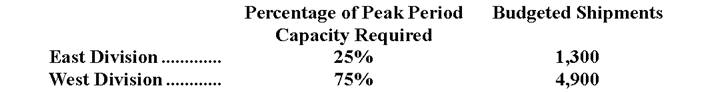

Marazzi Corporation has two operating divisions-an East Division and a West Division. The company's Logistics Department services both divisions. The variable costs of the Logistics Department are budgeted at $47 per shipment. The Logistics Department's fixed costs are budgeted at $328,600 for the year. The fixed costs of the Logistics Department are determined based on peak-period demand.  At the end of the year, actual Logistics Department variable costs totaled $333,270 and fixed costs totaled $340,240. The East Division had a total of 2,300 shipments and the West Division had a total of 4,600 shipments for the year.

At the end of the year, actual Logistics Department variable costs totaled $333,270 and fixed costs totaled $340,240. The East Division had a total of 2,300 shipments and the West Division had a total of 4,600 shipments for the year.

-How much actual Logistics Department cost should not be allocated to the operating divisions at the end of the year?

Definitions:

Cumulative Pretax Income

The total pre-tax income earned by a company over a specified period, before any taxes are deducted.

Useful Life

The period over which an asset is expected to be usable by an entity, affecting its depreciation or amortization schedules.

Revised Estimated

An updated forecast or projection based on new information or a more accurate assessment.

Depreciating Equipment

This refers to the reduction in the value of equipment over time due to wear and tear or obsolescence, recognized as an expense in accounting.

Q4: When computing the net present value of

Q16: The margin used in ROI calculations was

Q16: If Meacham decides to purchase the subcomponent

Q17: The standards for product J42 call for

Q29: Dowen Corporation applies manufacturing overhead to products

Q37: The performance measures on a balanced scorecard

Q41: (Ignore income taxes in this problem. )The

Q49: The fixed manufacturing overhead budget variance for

Q73: The purpose of the Data Processing Department

Q104: What is the net total dollar advantage