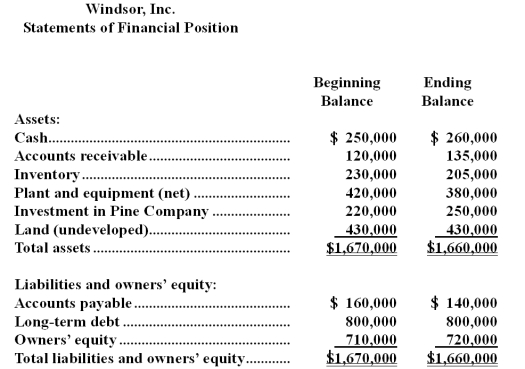

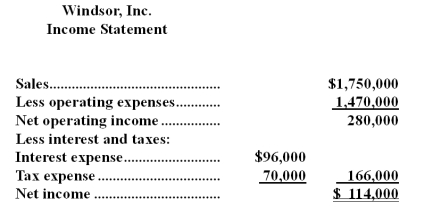

Financial data for Windsor,Inc.for last year appear below:

The company paid dividends of $104,000 last year.The "Investment in Pine Company" on the statement of financial position represents an investment in the stock of another company.

Required:

a.Compute the company's margin,turnover,and return on investment for last year.

b.The Board of Directors of Windsor,Inc.has set a minimum required return of 25%.What was the company's residual income last year?

Definitions:

Cannon-Bard Theory

A theory of emotion that argues that physiological arousal and the emotional experience occur simultaneously and independently.

Two-Factor Theory

A psychological theory proposing that emotional experiences arise from physiological arousal followed by the attribution of a cause for that arousal.

James-Lange Theory

A conceptual framework suggesting that physiological responses to incidents cause emotions to emerge.

Spillover Effect

The phenomenon where an experience or emotion in one area of life influences feelings or behaviors in another area.

Q11: If an investment has cash outflows of

Q13: Division X has asked Division K of

Q26: Last year the sales at Summit Company

Q50: The higher the denominator level of activity:<br>A)the

Q73: A spending variance is the difference between

Q77: The net present value of Project B

Q85: Peluso Company,a manufacturer of snowmobiles,is operating at

Q105: Tavorn Corporation applies manufacturing overhead to products

Q118: Spurrier Corporation produces two intermediate products,A and

Q135: Ignoring any salvage value,to the nearest whole