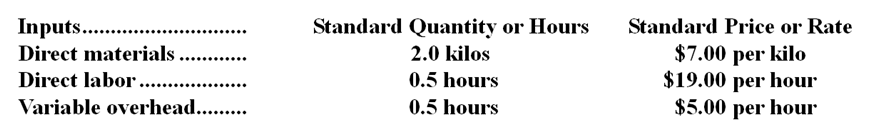

Landram Corporation makes a product with the following standard costs:  In March the company produced 4,700 units using 10,230 kilos of the direct material and 2,210 direct labor-hours. During the month, the company purchased 10,800 kilos of the direct material at a cost of $76,680. The actual direct labor cost was $38,233 and the actual variable overhead cost was $11,934.

In March the company produced 4,700 units using 10,230 kilos of the direct material and 2,210 direct labor-hours. During the month, the company purchased 10,800 kilos of the direct material at a cost of $76,680. The actual direct labor cost was $38,233 and the actual variable overhead cost was $11,934.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The variable overhead efficiency variance for March is:

Definitions:

Perpetual LIFO

A method of inventory valuation where the last items added to inventory are considered the first items sold, continuously updated in real-time.

Purchases and Sales

This involves transactions related to buying (purchases) and selling (sales) goods or services, critical to determining a business's revenue and inventory levels.

LIFO Perpetual

A perpetual inventory system method that assumes the last items added to inventory are the first ones sold, under the Last-In, First-Out principle.

Inventory Value

The total cost of all the items held by a company for resale or production purposes, calculated at a specific point in time.

Q9: The net operating income in the flexible

Q17: Suppose that Division X is operating at

Q39: Raybould Corporation has provided the following data

Q53: Igel Corporation makes a product with the

Q64: What is the budgeted accounts receivable balance

Q65: In addition to the facts given above,assume

Q70: A company has a standard cost system

Q139: Sroufe Clinic bases its budgets on the

Q149: The activity variance for personnel expenses in

Q244: Newsom Footwear Corporation's flexible budget cost formula