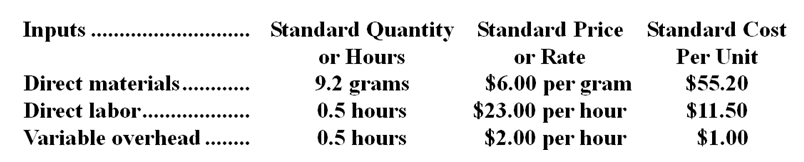

Sande Corporation makes a product with the following standard costs:  In November the company's budgeted production was 2,900 units but the actual production was 3,000 units. The company used 27,670 grams of the direct material and 1,390 direct labor-hours to produce this output. During the month, the company purchased 31,700 grams of the direct material at a cost of $196,540. The actual direct labor cost was $29,607 and the actual variable overhead cost was $2,502.

In November the company's budgeted production was 2,900 units but the actual production was 3,000 units. The company used 27,670 grams of the direct material and 1,390 direct labor-hours to produce this output. During the month, the company purchased 31,700 grams of the direct material at a cost of $196,540. The actual direct labor cost was $29,607 and the actual variable overhead cost was $2,502.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The materials price variance for November is:

Definitions:

Repetitive Process

A product-oriented production process that uses modules.

Assembly Line

A production process that breaks down the manufacture of a good into steps that are completed in a pre-defined sequence, enhancing efficiency through specialization and mechanization.

Q2: The variable overhead rate variance for supplies

Q18: Rostad Corporation applies manufacturing overhead to products

Q23: The variable overhead rate variance for June

Q30: A company has a standard cost system

Q46: Heersink Corporation bases its predetermined overhead rate

Q65: Stelluti Corporation's variable overhead is applied on

Q87: The labor rate variance is:<br>A)$480 F<br>B)$480 U<br>C)$440

Q98: The number of actual hours spent on

Q166: The spending variance for facility expenses in

Q239: The activity variance for net operating income