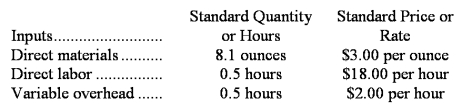

Leerar Corporation makes a product with the following standard costs:

In December the company produced 4,200 units using 34,870 ounces of the direct material and 1,900 direct labor-hours.During the month,the company purchased 39,700 ounces of the direct material at a total cost of $111,160.The actual direct labor cost for the month was $35,530 and the actual variable overhead cost was $3,990.The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased.

Required:

a.Compute the materials quantity variance.

b.Compute the materials price variance.

c.Compute the labor efficiency variance.

d.Compute the direct labor rate variance.

e.Compute the variable overhead efficiency variance.

f.Compute the variable overhead rate variance.

Definitions:

Standard Price

The predetermined cost that a company expects to pay for materials, labor, and other inputs, used as a benchmark for variance analysis.

Actual Grams

The real-world measurement of weight for materials used in a production or laboratory setting, as opposed to theoretical or estimated amounts.

Labour Efficiency Variance

The difference between the actual labor hours spent on production and the expected (or standard) labor hours, multiplied by the standard labor rate.

Actual Total Labour Cost

The real amount spent on wages and benefits for employees involved in the production process during a specific period.

Q1: Walsh Company expects sales of Product W

Q27: Sales in Year 1 amounted to:<br>A)$400,000<br>B)$900,000<br>C)$750,000<br>D)$1,200,000

Q30: The difference between cash receipts and cash

Q33: The excess (deficiency)of cash available over disbursements

Q80: A company's current net operating income is

Q94: The actual hourly rate of pay for

Q96: The personnel expenses in the planning budget

Q114: The selling and administrative expense in the

Q132: A labor efficiency variance resulting from the

Q195: The spending variance for occupancy expenses in