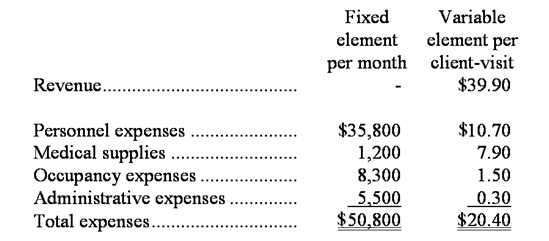

Gourley Clinic uses client-visits as its measure of activity. During August, the clinic budgeted for 3,200 client-visits, but its actual level of activity was 3,160 client-visits. The clinic has provided the following data concerning the formulas to be used in its budgeting:

-The activity variance for personnel expenses in August would be closest to:

Definitions:

Amortizable Capital Assets

Long-term assets whose cost is gradually expensed over their useful life, such as buildings and equipment.

Temporary Differences

Differences between the accounting value and tax value of assets and liabilities, resulting in deferred tax assets or liabilities.

Deferred Income Taxes

Taxes that are assessed or paid on income that is recognized in one period for financial reporting purposes but in a different period for tax purposes.

Fair Value Increments

Increases in the value of an asset or security that result from a reassessment of its fair value, often reflected in financial statements to show current market conditions.

Q10: Deschambault Inc.is working on its cash budget

Q30: The difference between cash receipts and cash

Q39: The accounts receivable balance,net of uncollectible accounts,at

Q52: The total number of units to be

Q62: Average operating assets are $110,000 and net

Q70: A company has a standard cost system

Q93: The division's margin is closest to:<br>A)26.2%<br>B)23.5%<br>C)2.7%<br>D)11.5%

Q103: Vitko Corporation makes automotive engines.For the most

Q106: The materials quantity variance should be computed:<br>A)when

Q142: The materials price variance for November is:<br>A)$2,145