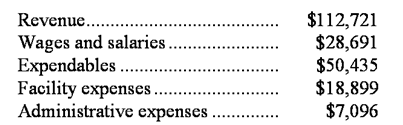

Roye Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During September, the kennel budgeted for 3,300 tenant-days, but its actual level of activity was 3,330 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for September:

Data used in budgeting: Actual results for September:

Actual results for September:

-The spending variance for expendables in September would be closest to:

Definitions:

Liquidity Preference Theory

Theory that investors demand a risk premium on long-term bonds. Implies that the forward rate generally will exceed the expected future interest rate.

Treasury Bond

A Treasury bond is a long-term, fixed-interest government debt security with a maturity of 20 to 30 years and pays interest every six months.

STRIPPED Cash Flows

Cash flows that are separated or "stripped" from an asset for investment or valuation purposes, often for the construction of zero-coupon bonds.

Arbitrage

The practice of taking advantage of price differences in different markets by buying low in one and selling high in another.

Q4: Jaster Corporation's management keeps track of the

Q7: How much overhead cost is allocated to

Q8: At the end of the year,actual manufacturing

Q26: What is the predetermined overhead rate to

Q42: Buis Corporation,which makes landing gears,has provided the

Q50: The credits to the Raw Materials account

Q59: Edwards Company has projected sales and production

Q151: Chapnick Clinic bases its budgets on the

Q153: The spending variance for direct materials in

Q236: The spending variance for medical supplies in