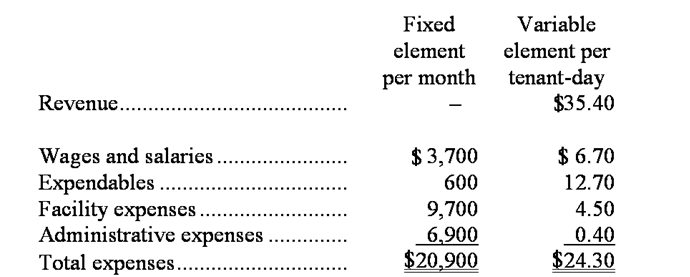

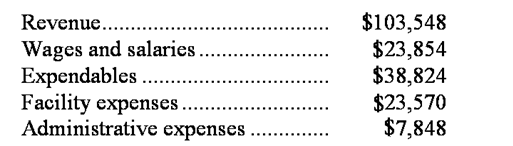

Clore Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During March, the kennel budgeted for 2,900 tenant-days, but its actual level of activity was 2,920 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for March:

Data used in budgeting: Actual results for March:

Actual results for March:

-The spending variance for facility expenses in March would be closest to:

Definitions:

Subchapter S Corporation

A form of corporation that meets specific Internal Revenue Code requirements and passes income, losses, deductions, and credits through to shareholders for federal tax purposes.

Alimony

Financial support paid by one ex-spouse to the other after divorce or separation, often mandated by the court.

Tax Ramifications

The effects or consequences that certain financial decisions or business transactions have on an individual's or entity's tax liability.

Periodic Payments

Regular payments received over a period of time, such as annuities, pensions, or dividends.

Q28: Although formal entry of standard costs and

Q31: The activity variance for administrative expenses in

Q39: The accounts receivable balance,net of uncollectible accounts,at

Q48: The administrative expenses in the planning budget

Q78: The total needs (i.e. ,production requirements plus

Q81: The direct labor in the planning budget

Q82: The manufacturing overhead in the planning budget

Q146: In an income statement segmented by product

Q150: Lafountaine Manufacturing Corporation has a standard cost

Q197: The purpose of a flexible budget is