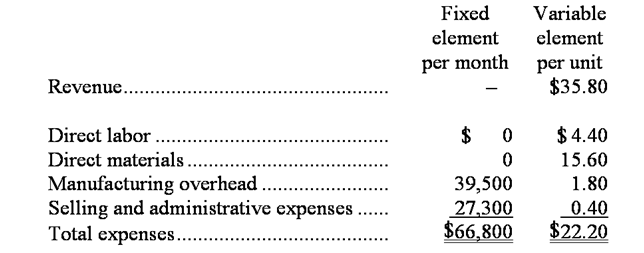

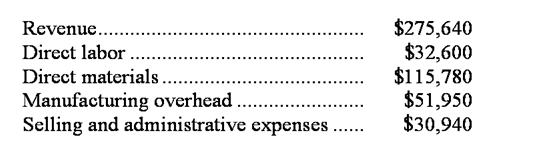

Mouton Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During July, the company budgeted for 7,300 units, but its actual level of activity was 7,350 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for July:

Data used in budgeting: Actual results for July:

Actual results for July:

-The manufacturing overhead in the flexible budget for July would be closest to:

Definitions:

Accounts Receivable

Accounts receivable represents money owed to a company by its customers for goods or services delivered but not yet paid for, classified as a current asset on the balance sheet.

Transfer Prices

Prices used for transactions between divisions of the same company, often used for budgeting and taxation purposes.

Actual Costs

The real costs incurred by a business, including all expenses related to production, operation, and maintenance.

Standard Costs

Predetermined costs for materials, labor, and overhead used in budgeting and assessing performance by comparing them to actual costs.

Q9: The Labor Rate Variance for December would

Q10: Activity-based costing is a costing method that

Q36: The spending variance for expendables in June

Q41: The activity rate for the Supervising activity

Q43: Petersheim Snow Removal's cost formula for its

Q53: Igel Corporation makes a product with the

Q59: The overall revenue and spending variance (i.e.

Q63: Galligan Corporation bases its budgets on the

Q173: Under variable costing,fixed manufacturing overhead cost is

Q288: The direct materials in the flexible budget