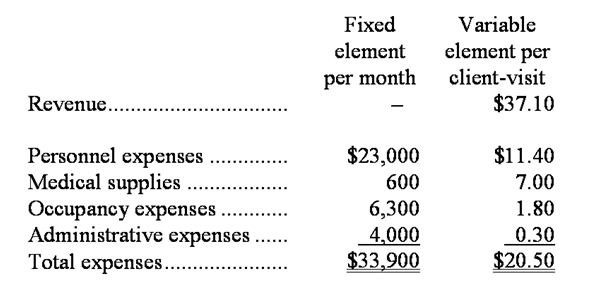

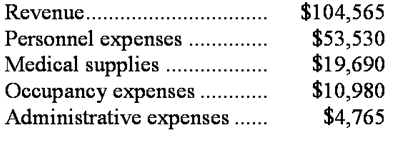

Diiorio Clinic uses client-visits as its measure of activity. During February, the clinic budgeted for 2,700 client-visits, but its actual level of activity was 2,750 client-visits. The clinic has provided the following data concerning the formulas used in its budgeting and its actual results for February:

Data used in budgeting: Actual results for February:

Actual results for February:

-The medical supplies in the flexible budget for February would be closest to:

Definitions:

Junk Bond

A high-yield bond with a lower credit rating, reflecting a higher risk of default but offering potentially greater returns.

High-Risk Bond

A bond with a lower credit rating, indicating a higher risk of default, but offering higher potential returns to compensate for this risk.

High Yields

Bonds that offer higher interest rates because they have lower credit ratings, implying greater risk of default.

Oligopolies

Markets dominated by a small number of large firms, leading to limited competition.

Q30: The direct labor in the planning budget

Q41: The net operating income in the flexible

Q47: Imme Corporation's variable overhead is applied on

Q64: Dreyfus Memorial Diner is a charity supported

Q88: The activity rate for the Machining activity

Q134: The variable overhead efficiency variance for February

Q187: Hansen Company produces a single product.During the

Q214: The direct materials in the flexible budget

Q260: Blockmon Hospital bases its budgets on patient-visits.The

Q267: The activity variance for wages and salaries