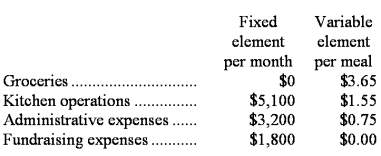

Socha Memorial Diner is a charity supported by donations that provides free meals to the homeless.The diner's budget for January was based on 3,400 meals,but the diner actually served 3,800 meals.The diner's director has provided the following cost formulas to use in budgets:  The director has also provided the diner's statement of actual expenses for the month:

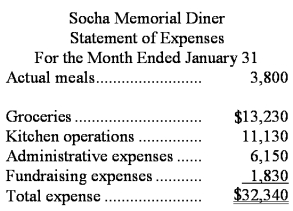

The director has also provided the diner's statement of actual expenses for the month:  Required:

Required:

Prepare a report showing the activity variances for each of the expenses and for total expenses for January.Label each variance as favorable (F)or unfavorable (U).

Definitions:

Double Time

A rate of payment that is twice the regular wages, often paid for working on holidays or outside of normal working hours.

Time and a Half

An overtime pay rate, typically 1.5 times the employee's regular hourly wage, paid for hours worked beyond the standard workweek.

FICA Tax

Federal Insurance Contributions Act tax, a U.S. federal payroll tax funding Social Security and Medicare benefits.

Federal Income Tax

A tax levied by the IRS on the annual earnings of individuals, corporations, trusts, and other legal entities.

Q1: The following standards have been established for

Q4: The fixed manufacturing overhead cost applied to

Q16: Fongeallaz Clinic bases its budgets on the

Q57: The activity variance for administrative expenses in

Q58: Cockriel Inc. ,which produces a single product,has

Q59: Edwards Company has projected sales and production

Q69: A manufacturing company that produces a single

Q86: The variable overhead rate variance for February

Q95: What was the fixed manufacturing overhead budget

Q102: Would the following activities at a manufacturer