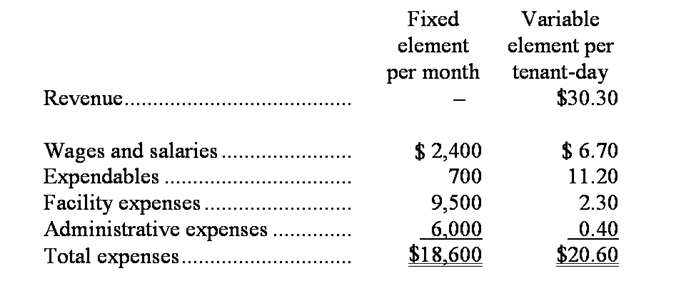

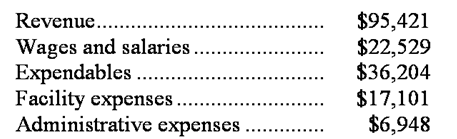

Arkin Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During May, the kennel budgeted for 3,100 tenant-days, but its actual level of activity was 3,070 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for May:

Data used in budgeting: Actual results for May:

Actual results for May:

-The administrative expenses in the planning budget for May would be closest to:

Definitions:

Temporary Difference

A discrepancy between the tax basis of an asset or liability and its carrying amount on the balance sheet, which will eventually settle and affect taxable income.

Book Income

A company's income as reported in its financial statements, representing the difference between revenues and expenses.

Income Tax Rate

The portion of a person's or company's earnings that is handed over to the state in the form of taxes.

Deferred Income Tax Liability

A tax obligation that a company owes but has not yet paid, resulting from temporary timing differences between its accounting earnings and its taxable income.

Q7: The total number of units produced in

Q11: Meares Corporation bases its budgets on the

Q25: The following standards for variable overhead have

Q36: Durrant Corporation has provided the following data

Q50: The credits to the Raw Materials account

Q83: Hagos Corporation is working on its direct

Q114: Kornfeld Corporation produces metal telephone poles.In the

Q125: The total cost at the activity level

Q126: The occupancy expenses in the flexible budget

Q276: Flexible budgets cannot be used when there