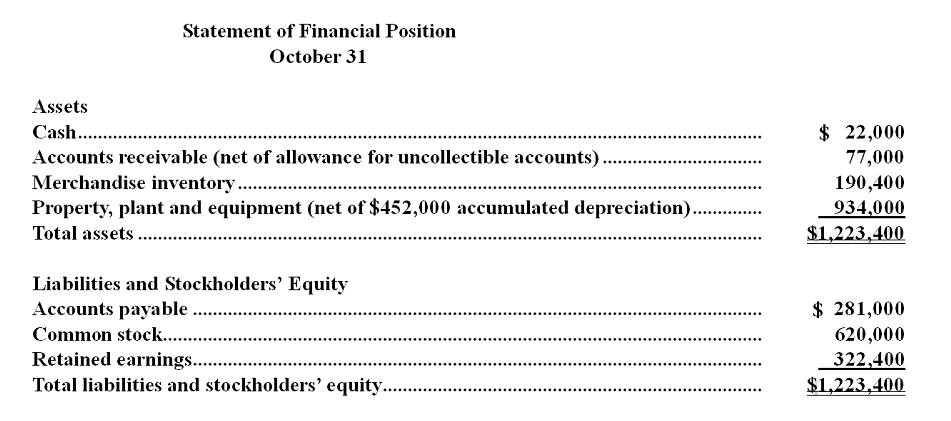

Brarin Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow:

• Sales are budgeted at $340,000 for November, $360,000 for December, and $350,000 for January.

• Collections are expected to be 55% in the month of sale, 44% in the month following the sale, and 1% uncollectible.

• The cost of goods sold is 80% of sales.

• The company would like to maintain ending merchandise inventories equal to 70% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase.

• Other monthly expenses to be paid in cash are $23,100.

• Monthly depreciation is $21,000.

• Ignore taxes.

-The difference between cash receipts and cash disbursements in December would be:

Definitions:

Plantwide Factory Overhead Rate

A single overhead absorption rate used throughout an entire plant or factory to allocate overhead costs to products.

Activity-based Costing

An accounting method that assigns costs to products and services based on the activities and resources that go into creating them, aiming for more accurate costing.

Indirect Labor Costs

Costs related to labor that cannot be directly tied to the production of specific goods or services, such as maintenance personnel or supervisors.

Activity-based Costing

An accounting method that assigns costs to products based on the activities involved in manufacturing or providing a service.

Q41: The master budget is a network consisting

Q62: Customer-level activities relate to specific customers and

Q77: The activity variance for direct labor in

Q94: Moore Company produces a single product.During last

Q98: The beginning inventory in units for September

Q106: The net operating income for the year

Q144: The activity variance for administrative expenses in

Q153: The spending variance for direct materials in

Q205: South Company sells a single product for

Q225: Hamner Corporation's flexible budget performance report for