Addy Company makes two products: Product A and Product B. Annual production and sales are 1,700 units of Product A and 1,100 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labor-hours per unit and Product B requires 0.6 direct labor-hours per unit. The total estimated overhead for next period is $98,785.

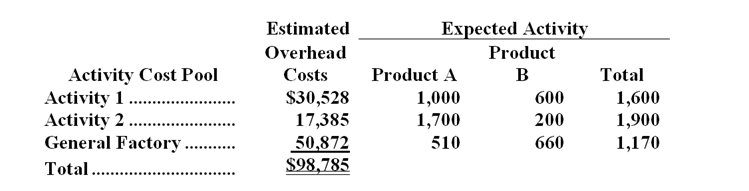

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows: (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The predetermined overhead rate under the traditional costing system is closest to:

Definitions:

Materials Cost

The total expense incurred by a company to purchase raw materials used in the production of goods or services.

Process Costing

A costing method used for homogeneous products, where costs are accumulated over a period and assigned to large numbers of identical units.

Cost Per Equivalent Unit

A calculation used in process costing that determines the cost associated with a single unit of output, adjusting for partial completion of units in the production process.

Materials Cost

The cost of raw materials used to produce goods.

Q2: An action analysis report provides more detail

Q24: Under variable costing,costs that are treated as

Q29: The net operating income in the flexible

Q30: How much cost,in total,would be allocated in

Q65: What is the unit product cost for

Q112: The standards for product U31 call for

Q148: The overall revenue and spending variance (i.e.

Q173: Under variable costing,fixed manufacturing overhead cost is

Q188: The carrying value on the balance sheet

Q253: The overall revenue and spending variance (i.e.