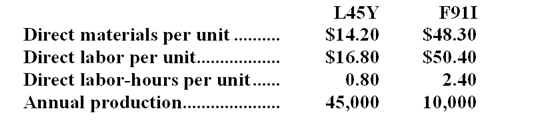

Scholes Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs) . The company has two products, L45Y and F91I, about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $3,170,400 and the company's estimated total direct labor-hours for the year is 60,000.

The company's estimated total manufacturing overhead for the year is $3,170,400 and the company's estimated total direct labor-hours for the year is 60,000.

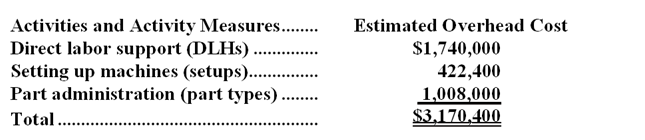

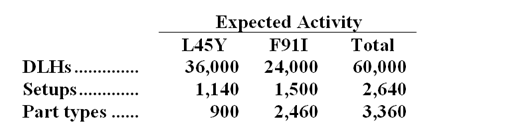

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-The unit product cost of product F91I under the activity-based costing system is closest to:

Definitions:

Units Transferred Out

The term used in cost accounting to refer to products or goods that have been completed and moved out of the work-in-process accounts into finished goods inventory.

Total Cost

The aggregate amount of expenses incurred by a company to produce goods or services, including fixed, variable, and semi-variable costs.

Weighted-Average Method

An inventory costing method that assigns an average cost to each unit of inventory, incorporating all units available for sale.

Processing Department

This refers to a division within a business that handles the processing of materials or information.

Q10: The spending variance for power costs in

Q20: Maccarone Corporation has provided the following data

Q66: Selling and administrative expenses are considered to

Q97: The activity rate for the Order Filling

Q122: Brandewie Corporation bases its budgets on the

Q127: The personnel expenses in the planning budget

Q130: What is the unit product cost for

Q134: Reach Consulting Corporation has its headquarters in

Q167: The variable expense per unit is:<br>A)$10.00 per

Q230: The variable expense per unit is $12